MENAPAY

Alternative payments refer to payment methods that are used as an alternative to traditional payments. Most alternative payment methods discuss the domestic economy or have been developed specifically for electronic commerce and payment systems are generally supported and operated by local banks. Each alternative payment method has a unique application and process settlement, language and currency support and subject to domestic rules and regulations.

A debit card also known as a bank card or check card is a plastic card that provides a traditional alternative payment method for cash when making a purchase. A charge card is a plastic card that provides an alternative to cash when making purchases where the issuer and card holder enter into an agreement that the debt incurred in the billing account will be paid in full and on the due date.

MenaPay is the first block-based payment gateway that is fully supported in the Middle East and Africa. EdenPay replaces traditional payment methods with cryptocurrency fully supported by blockchain. Mission MenaPay is building web-based websites and applications that will allow integration of crypto payment solutions to various websites and supports Arabic on the dashboard.

New payments like Bitcoin and other cryptocurrency solutions have disappointed us because they are expensive and involve large and improper transaction costs for your daily payment needs such as buying groceries, paying for taxis and other services available for each day. EdenPay aims to change the status quo by bringing 100% non-bank Islamic digital solutions, use blockchain to create a single currency for use in daily and cross-border transactions, https://www.menapay.io/

We create new standards in the crypto industry for participatory returns, beyond regular incentives for users and investors.

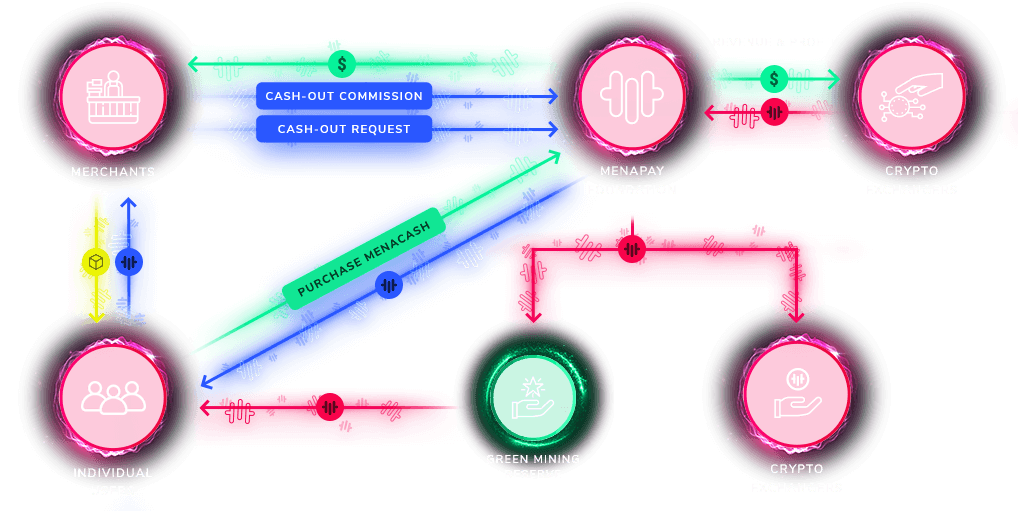

- P2P transactions

-P2M Peer to Merchant Payment

-Merchant M2F to Foundation

-Green Mining

In further developments the implementation of this program is the North Africa and Middle East regions. With technology advancing and the entire Blockchain ecosystem growing at a commendable pace, much of the development takes place in several pockets of the world. The Middle East and North Africa have so far remained isolated from growth on the Blockchain. This region is under the banking infrastructure that was developed due to Islamic Sharia law which prohibits interest on loans. As a result, the GCC region has sharia-compliant financial institutions that represent about 1% of the world's total assets. This region also has a very fragmented with various currencies that have banned the integration of all regions into one market.

Onepager: https://www.menapay.io/onepager.pdf

Facebook: https://www.facebook.com/menapayio

Twitter: https://twitter.com/menapayio

Telegram: https://t.me/MenaPay

Instagram: https://www.instagram.com/menapay

Ann Threads: https://bitcointalk.org/index.php?topic=4884588

Author : ranran pratama

Profile link : https://bitcointalk.org/index.php?action=profile;u=2044562

Tidak ada komentar:

Posting Komentar