What is DAGT?

DAGT (Digital Assets Guarantee Token) is a digital asset credit assurance platform based on Ethereum's public blockchain technology and intelligent contract technology. The goal is to build transparent information, efficient collaboration, and high value transfer of digital assets. Trusting a distributed credit system Throughout the credit environment, users can use a "DAGT" pass or other pass to pay for credit service fees to obtain financial services provided by financial institutions working with the DAGT.

According to the actual needs of the users, the DAGT system is built on the publicly available Ethereum blockchain and intelligent contract. Some of the benefits of blockchain are that it can not be tampered with because it is a decentralized technology. DAGT uses blockchain technology to build and set up new features, such as archiving and transferring assets.

The new features of blockchain technology allow us to redefine the value of the lender’s assets and completely eliminate the need to trust the loan process. In the meantime, based on the open and transparent intelligence of the Ethereum platform, trust and cooperation between us and our lenders have been further strengthened in order to reach the design concept. The party benefits both parties.

DAGT is a decentralized digital asset credit system that provides the foundation for trust, smart, efficient, open, transparent, mobile and full digital asset owners.

The new features of blockchain technology allow us to redefine the value of the lender’s assets and completely eliminate the need to trust the loan process. In the meantime, based on the open and transparent intelligence of the Ethereum platform, trust and cooperation between us and our lenders have been further strengthened in order to reach the design concept. The party benefits both parties.

DAGT is a decentralized digital asset credit system that provides the foundation for trust, smart, efficient, open, transparent, mobile and full digital asset owners.

Project Participants

User (C side)

- DAGT Pass Holders users who use their own digital assets to start credit qualification applications

- Users who are optimistic about the future of digital assets and want to hold them for a long time, but have liquidity requirements in the short to medium term

DAGT Foundation

- DAGT Foundation (nonprofit), responsible for the development, operation and promotion of DAGT projects

- Based on blockchain technology, to provide credit users with digital asset loans and credit services

Loan Institution (B)

- Organizations that comply with relevant national laws and have loan qualifications, such as banks, online loan companies, small lending companies, etc.

- DAGT system will interact with third party lending institutions.

The first industry

The first digital assurance credit platform based on blockchain technology

Profit sharing

In the operation process, DAGT licenses from the return platform are distributed to users who have downloaded the DAGT mobile app and are using the wallet transaction function.

Strong team

Strong technical, market and international operations team, with over one year experience in blockchain technology, financial institutions and community operations and excellent performance

Fast landing

Progress of project development has reached 50%, and has reached the intention of cooperation with a number of lending institutions.

STEP 1. Credit Application

Register a member account and apply a credit application

STEP 2. Enter credit information

Credit users enter credit information

STEP 3. Lock smart contract

Continue the promise of digital assets to a smart contracting framework

STEP 4. Give Letter to Make Loan Problem

Grant Letter for Creating a Grant Loan: DAGT Co-operative Loan Institution provides loan funds to bank accounts based on credit information and audits basic creditor information.

system architecture

Will provide Web-based user function entries, such as: APP, PC, etc.;

TPGS

Using blockchain technology, credit user registration, credit extensions, and appointment services are platform, smart, and real-time. Credit users can quickly complete the crediting process and send user credit information to third-party lenders in real-time.

Data and API services

TPGS will open some API and interface data to third party lenders, and DAAD will access a number of digital asset exchanges through the API interface;

Layanan oracle Oracle

Through Oracle oracle to open the chain of communication outside the chain, to achieve reliable business data processes outside the chain and the digital asset intelligence contract in the chain;

DEED

Interconnection of automated trading systems with third-party digital asset trading platforms to perform functions such as digital asset monitoring, delivery, early warning, and large data analysis, and intelligent contract integration to openly and transparently manage assured products;

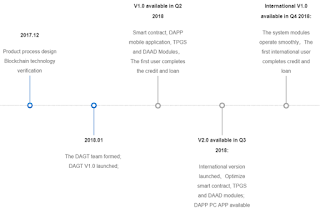

ROADMAP

TEAM

For more information and joining Dagt's social media at this time please follow some resources for the following references:

Author : ranran pratama

Profile :

https://bitcointalk.org/index.php?action=profile;u=2044562

Tidak ada komentar:

Posting Komentar